Loan Approvals

Don't let bad credit stand in your way.

Once a black mark is on your file, it can remain for up to seven years, regardless of whether you have paid out the default or not. This can make it difficult to be approved for any type of credit, whether it be taking out a loan or entering into a phone contract. Each time you apply, your credit file is likely to be checked by the credit provider.

Repairing your credit file can:

- Increase your chances of being approved

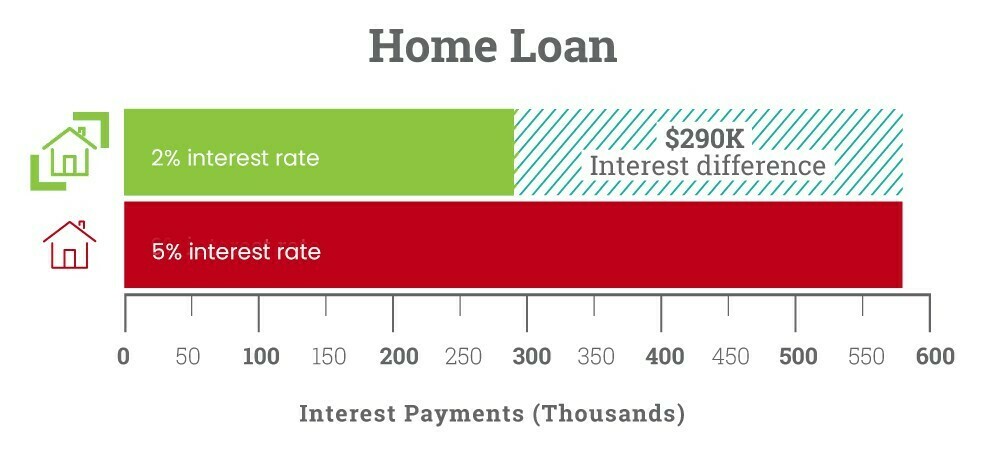

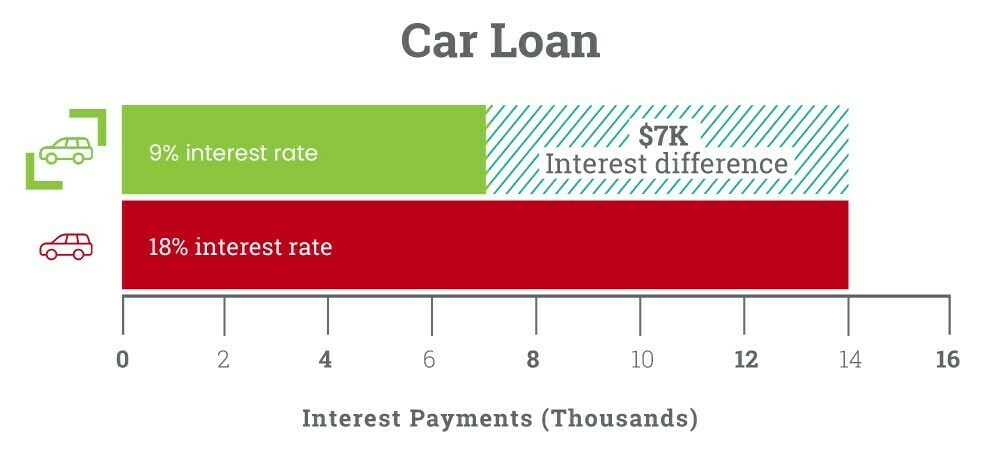

- Lower the interest rates you have to pay

- Lower the fees you have to pay

- Increase your credit score

- Free you up financially

There are certain credit providers that may be willing to lend to individuals with impaired credit files, however, these credit providers generally charge higher fees and interest chargers.

By repairing your credit file prior to taking out a loan, you may get approval for a more favourable deal with lower interest rates, which can save you thousands. Let’s take a look at an example.

Compare the pair

Contact Us